Money May

Welcome to the MoneyPlus Newsletter.

This month its Money May, and we’re focusing on ways that we can help you save on everyday expenses, right through to claiming back thousands through a new PPI wave – are you eligible? Find out below…

Claim back up to £40k with MoneyPlus Legal.

The PPI 2 storm is upon us, but we’re prepared.

The initial PPI scandal, which cost banks and lenders £38 billion in compensation, came to an end in August 2019. Since then, a new wave of PPI claims (dubbed PPI 2), have emerged, allowing customers who have already received compensation or had their previous claim rejected to make a claim once more.

These new claims follow a 2017 decision by the Financial Conduct Authority (FCA), which decided that banks and lenders should pay back customers any amount of undisclosed commission that was charged at over 50%, plus interest; in some cases, commission has been charged at over 90% of the initial PPI cost!

The FCA estimate that PPI 2 payouts could total more than £33bn, with the Financial Times also estimating there to be about 10 million outstanding PPI claims.

Are you eligible to claim?

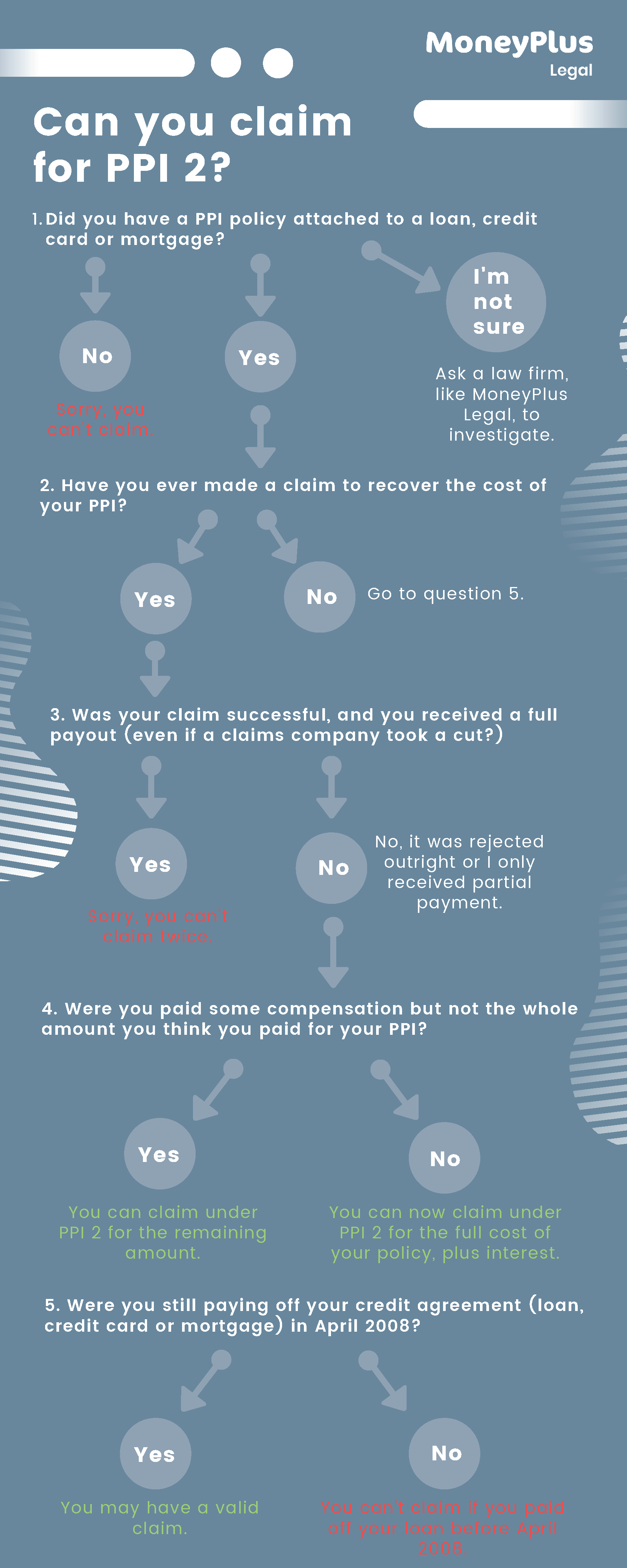

MoneyPlus Legal is currently helping thousands of customers make new PPI claims for up to £40,000; if you’ve previously submitted a PPI claim, whether it’s been successful, rejected, or lost, you could still get a pay-out.

Take a look below to see whether you could be eligible to claim…

Click here for more information and to get in touch with us about a PPI 2 claim.

You can also read our latest mention in national press to hear how we’re battling the storm.

Meet our MoneyPlus Advisors.

Our Advisors are the backbone of our company, and without them we wouldn’t be able to provide our thousands of customers with top-notch service on a daily basis – they really are that good!

We’ve recently detailed some of our Customer Stories for Debt Awareness Week back in March, but we’d like to take the time to tell our Advisor Stories, so that you can hear about the kinds of conversations our Advisors have, and how their jobs help thousands of people, everyday.

Our Advisor Stories video is coming soon – watch this space!

Introducing… Advice Online!

Our online debt advice service, Advice Online, will soon be up and running and helping people from all walks of life to get their finances back on the right track.

If you have debts that you’d like to get on top of, but speaking about them seems overwhelming, Advice Online can help.

What is Advice Online?

We realise that picking up the phone to speak about something as personal as finances and debt can be very daunting, so we’ve created a simple online tool that lets you find out which solutions are available to you, all without the need for a phone call. You’ll answer the same questions you would usually be asked on the phone, including filling out your income & expenditure.

If you need some time before you progress to the next step, you can save your progress and come back at a later point.

Advice Online is an easy and stress-free alternative to picking up the phone, but our expert Advisors at MoneyPlus Advice will always be here if you prefer to call.

We’ll be launching Advice Online next month on desktop and mobile, so keep an eye on your emails for more information!

Quick penny pinchers.

Looking to save a few coins here and there? You’re in luck. Here are 11 quick ways you can save a little cash for your piggy bank.

- If you have the space, try drying your clothes on a washing line instead of the tumble dryer. Energy experts say you add more than 60p to your electricity bill every time you turn on the tumble. Your clothes will smell great too!

- Buy food with discounted yellow stickers on. Most supermarkets have a dedicated shelf and fridge for discounted items. Find out where it is and get first dibs.

- Make your own popcorn. It’s ridiculously easy – and cheap. You can even add your own seasoning or flavourings; just put it all in a large bowl, settle back and enjoy.

- Flog your fruit! Roll a lemon on a work surface before squeezing it. You’ll get twice as much juice. When you’ve finished with it, stick it in a bowl of hot water in the microwave for three minutes. It will steam-clean the inside and leave it smelling fresh.

- Use scrunched up tin foil to clean oven trays rather than expensive scouring pads. The tin foil doesn’t even need to be clean. Use the piece you’ve used for cooking.

- Cook in bulk. It takes minimal effort (and cost) to make twice as much lasagne. Then either take the other half to work for packed lunches or stick it in the freezer to enjoy another time. (Before you fling anything in the freezer, stick a label on it. It might look like a lasagne now, but when it’s frozen solid, it can be difficult to tell).

- When you unpack food shopping, get in the habit of popping as much as possible into the freezer. Keep a sliced loaf in there and then just take out individual slices for toast and sandwiches.

- Be sure you’re shopping based on price and quality, not branding. Try swapping a couple of your usuals for own-brand alternatives. Often, the stripped down version is produced in the same factory, and for cleaning products, medication, and cupboard staples like flour, salt and vinegar, the two are almost identical.

- Petrol that is labelled as ‘premium unleaded’ on forecourt pumps – such as Shell Fuelsave – is actually standard petrol. When it comes to fuel, ‘super’ is more expensive than ‘premium’.

- Dried pet food has a much longer shelf life so it’s worth stocking-up when it’s on special offer. If you shop online, most suppliers will offer good discounts and free delivery for bigger orders. Keep an eye out for special offers and freebies too.

- Charge your mobile at work, rather than at home. Cheeky but cheaper!

Meet the team.

Richard Fletcher – Head of Financial Operations

Richard says: “I first joined MoneyPlus in 2017, and I’m currently head of our Financial Operations department, which services the Group in helping thousands of customers across the UK with their energy, finances, and legal claims.

My role as Head of Financial Operations is incredibly rewarding because I really enjoy the diversity of our product offering. Working to support the business across each of these products means I am continuously learning and developing new skills on an almost daily basis, it’s certainly never dull!

What sets MoneyPlus apart from the rest is our ability to always put our customers first. It’s a testament to our employees that they embrace that culture, but that could not be made possible without the support network that is provided by MoneyPlus to enable us provide the best possible service we can to our customers. I have never worked for an organisation that has invested so much in its employees, and I just feel incredibly lucky to be part of that team!“

Review of the month.

We love reading our customer reviews – and showing them off to the world!

This month’s review comes from a very valuable MoneyPlus Energy customer.

Take a look…

In case you didn’t know, every Friday is #FeedbackFriday on our social media, so if you’d like to see more great reviews, head over to our Facebook, Twitter, or Instagram!

If you’d like to leave a review for us, head over to our MoneyPlus Advice or MoneyPlus Legal review pages – we can’t wait to read it!

Social scene.

We like to keep our followers up-to-date with the latest industry news, advice, and offers, so we highly recommend following our social media channels so you can stay in the know…

WIN a beautiful bouquet from Bloom & Wild!

Every month, HUNDREDS of our followers enter into our #12MonthsOfBloom competition to win a stunning bouquet courtesy of MoneyPlus, and we announce the month’s five lucky winners on our social channels!

Do you want to be in with a chance to win? Just follow these steps:

1. Like our Facebook page

2. Then share our latest Bloom & Wild post with the hashtag #12MonthsOfBloom.

Simple! (Don’t forget to set your shared post to ‘public’, otherwise we won’t be able to see who shares it!)

Winners will be announced at the beginning of next month, so stay tuned to our social to see if you’ve won.

T&C’s apply

Here for you, in more ways than one.

At MoneyPlus, we offer a range of services that help you to make the most of your finances and live better. Take a look below to see if you could benefit from one (or more) of our other offerings…

Debt solutions that suit your lifestyle.

If your personal circumstances have changed and you find yourself struggling to manage your finances, give MoneyPlus Advice a call on 0161 837 4000, or email us at info@moneyplus.com, and we’ll help you find the best solution to get your finances back on the right track.

Helping you claim back what’s yours.

Many think PPI is a thing of the past, but it isn’t too late to claim. Even if you’ve already been paid out compensation for mis-sold PPI, or were rejected, we could help you.

We’re a fully regulated law firm acting for tens of thousands of people who are rightfully claiming back the money they’re owed from their PPI. Click here to start your PPI check today.